Product Description

Meet your new go-to financial confidence booster: The “Catch Me If I Fall” Checklist. This easy-to-follow digital download is designed to help you build a dependable emergency fund, strengthen your financial safety net, and feel secure no matter what life throws at you. Whether you’re just starting your money journey or rebuilding after a setback, this guide simplifies every step so you can create lasting stability without overwhelm.

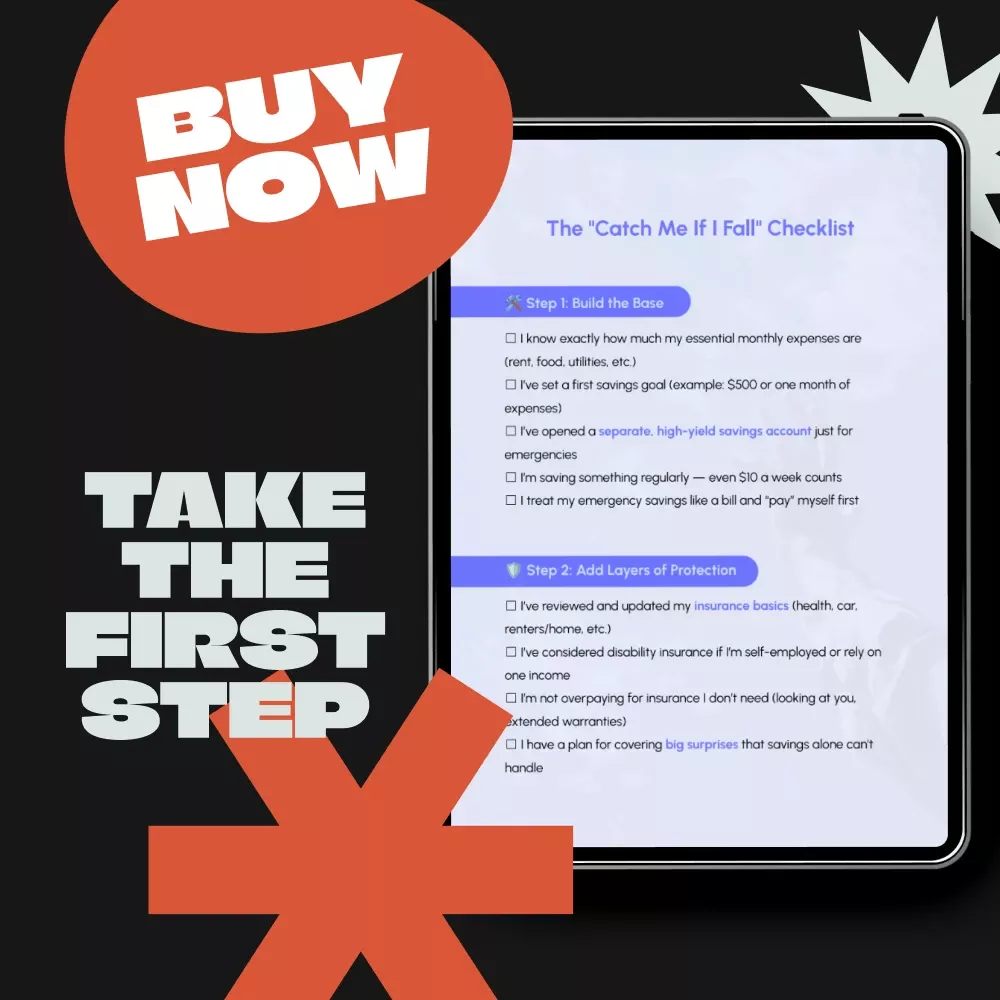

What’s Inside

- Step 1: Build the Base — Clarify your essential monthly expenses, set your first savings goal, open a high-yield savings account, and start saving consistently.

- Step 2: Add Layers of Protection — Review your insurance basics, consider disability coverage, stop overpaying for unnecessary add-ons, and prepare for big surprises.

- Step 3: Keep It Growing — Learn how to revisit, refill, and protect your emergency fund throughout major life changes.

- Step 4: Turn Security Into Opportunity — Explore new income stream ideas and use your stable foundation to grow, invest, or launch passion projects.

Key Benefits

- Perfect for beginners who want a simple, encouraging path to financial stability.

- Ideal for busy adults who need a quick, clear checklist rather than a long, overwhelming guide.

- Helps you finally understand what a real safety net looks like — and how to build one step by step.

- Supports you in forming strong money habits, setting realistic goals, and protecting your future.

- Unlike generic budgeting printables, this checklist is designed specifically for creating a resilient, layered emergency plan.

Who This Is For

This digital checklist is perfect for anyone who wants to feel more secure with their money: students, new graduates, young professionals, parents, freelancers, and anyone building financial peace from the ground up.

Why It’s Different

Most financial downloads focus on budgeting alone. The “Catch Me If I Fall” Checklist goes deeper—showing you not just how to save, but how to protect your savings, maintain it over time, and use it as a launchpad for future opportunities. It’s practical, encouraging, and designed for real life.

Call to Action

Take the first step toward feeling safe, supported, and financially prepared. Download The “Catch Me If I Fall” Checklist today and start building the security you deserve—one simple step at a time.

Order cancellation

All orders can be cancelled until they are shipped. If your order has been paid and you need to make a change or cancel an order, you must contact us within 12 hours. Once the packaging and shipping process has started, it can no longer be cancelled.

Refunds

Your satisfaction is our #1 priority. Therefore, you can request a refund or reshipment for ordered products if:

- If you did not receive the product within the guaranteed time( 45 days not including 2-5 day processing) you can request a refund or a reshipment.

- If you received the wrong item you can request a refund or a reshipment.

- If you do not want the product you’ve received you may request a refund but you must return the item at your expense and the item must be unused.

We do not issue the refund if:

- Your order did not arrive due to factors within your control (i.e. providing the wrong shipping address)

- Your order did not arrive due to exceptional circumstances outside the control of Sale Picks Boutique (i.e. not cleared by customs, delayed by a natural disaster).

- Other exceptional circumstances outside the control of

*You can submit refund requests within 15 days after the guaranteed period for delivery (45 days) has expired. You can do it by sending a message on Contact Us page

If you are approved for a refund, then your refund will be processed, and a credit will automatically be applied to your credit card or original method of payment, within 14 days.

Exchanges

If for any reason you would like to exchange your product, perhaps for a different size in clothing. You must contact us first and we will guide you through the steps.

Please do not send your purchase back to us unless we authorise you to do so.

Instant download

Your purchase will be available to download once payment is confirmed.

Instant download items don’t accept returns, exchanges or cancellations. Please contact us if you have any problems

simple clear and encouraging

👍

Finally! A guide that makes sense to me.

the way this planner helped me understand the concept of safety net was amazing... now i know how to build mine step by step.

Impressive

It’s like having a personal finance coach at hand

This planner has been my saving grace in forming strong money, this checklist has been a godsend. It simplifies everything into habits and setting realistic goals. Unlike other generic budgeting printables, manageable steps and helps you build your safety net from scratch. Plus, it’s specifically designed for creating a resilient emergency plan which makes it stand it’s digital so I can access it anywhere, anytime.

helpful

Can't recommend it enough!

it's ideal for us adults who don’t have time to read lengthy guides.. quick yet detailed.. love it!!

Makes building an emergency fund less daunting

i’m new to managing finances and just about managing money; it's about securing your future.

As someone who's always struggled with understanding the concept of an emergency fund, this checklist was a breath of fresh air. It not only helps you understand what a real safety net looks like but also guides you on how to build one step by step.

I've tried numerous financial planning tools before

recommend

Gives you all the necessary means i can carry it everywhere with me.

I've tried many budgeting guides before but nothing compares to but none were as straightforward and effective as this one. Ideal for busy this one. What sets it apart is its focus on creating an emergency adults who need something quick yet comprehensive. I can't recommend it enough fund - something that often gets overlooked in other guides. It's not!

ok

As someone who's always struggled with understanding financial terms>

practical